Meaningful Climate Reporting in Australia

Preparing Australia’s Asset Managers and Owners for the ASRS Era

Canbury is pleased to release a report analysing the readiness of Australian financial institutions for the recently introduced Australian Sustainability Reporting Standards (ASRS). The ASRS offers a framework for transparency, and aligning risk, strategy, and long-term value in a changing economy.

This report provides the first comprehensive benchmark of industry preparation. Encouragingly we found that overall, the foundations of climate reporting are in place. However, what is often missing is the level of detail now required under the new standards.

Key Insights

1- Mid-Sized Entities Lead: Entities with $10B–$50B in assets under management show the highest disclosure alignment rates, meeting 36% of requirements on average.

2- Governance First, Data Later: Most entities disclose governance structures and high-level strategy as a first step, but few include AASB S2 compliant targets or emissions data.

3- Asset Owners’ & Managers’ Unique Strengths: Asset owners tend to provide more comprehensive narrative disclosures, whereas asset managers sometimes excel in governance but lag in strategy detail.

Turning ASRS Preparation into Competitive Advantage

For Asset Managers

- Stand out with investor-grade disclosures by clearly communicating your impact through qualitative insights and quantitative metrics

- Enhanced client value propositions through transparent sustainability integration

- Streamline reporting by aligning systems with ASRS

For Asset Owners

- Strengthen investment decision-making through comprehensive climate data

- Demonstrate fiduciary responsibility through robust sustainability frameworks

- Position your entity as a leader in Australia’s sustainable finance transformation

Your Strategic Roadmap: Comprehensive ASRS Preparation Guidance

Our full analysis provides actionable insights across all four ASRS pillars:

✅ Governance Excellence – Strengthening board oversight and management accountability frameworks

✅ Strategic Integration – Embedding climate considerations into core business strategy and planning

✅ Risk Management – Developing robust climate risk identification, assessment and management processes

✅ Metrics & Targets – Creating credible, measurable commitments that demonstrate progress and accountability

Watch the webinar

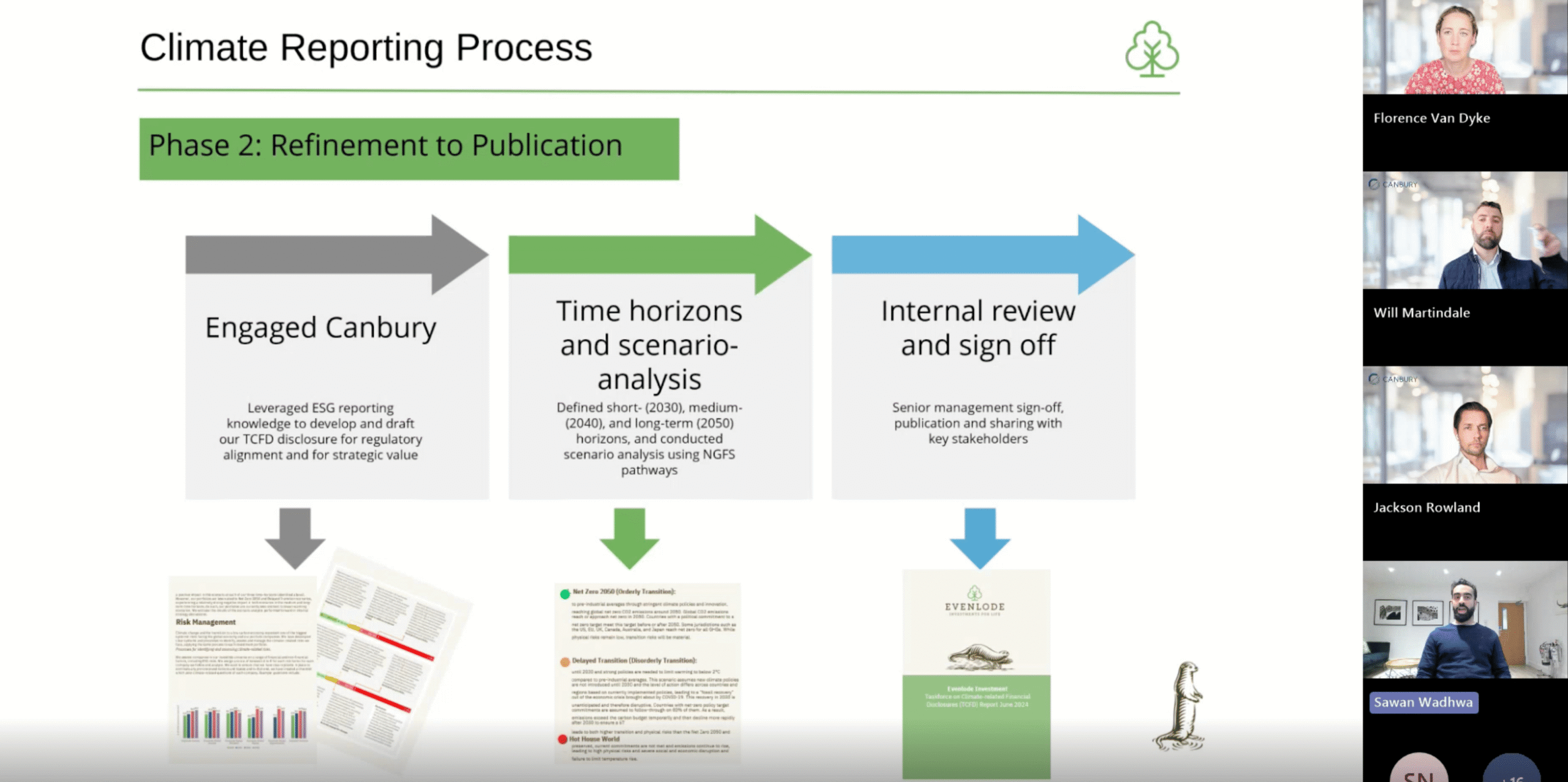

Canbury recently hosted a webinar sharing the findings of our report including a case study on strong climate disclosure best practice from Sawan Wadwa at Evenlode.

You can watch the full recording below.